CHEESE: CATEGORY SNAPSHOT

According to IRI, total U.S. Retail Cheese (defined as fixed + random weight cheeses) volume saw strong growth when consumers were largely at home during the 2020-21 pandemic years. Average annual growth for total retail cheese between 2019 and 2021 was 4.5%. Given economic uncertainties and high inflation, cheese sales experienced a small downturn in 2022. Looking more closely, the average price for cheese in 2022 was up 8% compared to the preceding year. While volume was down -0.1% for 2022 through December 25 (51 weeks) 2022, volume flattened during the IRI’s latest six-week period including the recent holiday period.—Source: Dairy Management Inc.

Inflation Takes a Bite but Consumers Still Say “Cheese!”

*By IRI 52-week sales data, the top five selling forms of cheese by volume are Sliced (20.5%), Shredded Regular (18.1%), Chunk (17.9%) Shredded Fine (12.3%) and Spread (5.9%). Sliced, chunk, and shredded fine cheeses were the only forms posting year-over-year volume increases.

*Hispanic varieties of cheese, while still small, have been growth pockets with strong gains during the last few years, continuing into 2022. In particular, Queso Quesadilla, Panela, Cotija and Queso Blanco cheeses have experienced strong sales lifts.

*Parmesan cheese has sold well throughout the course of the pandemic and it continued to post small growth in 2022, with a larger uptick over the holidays.

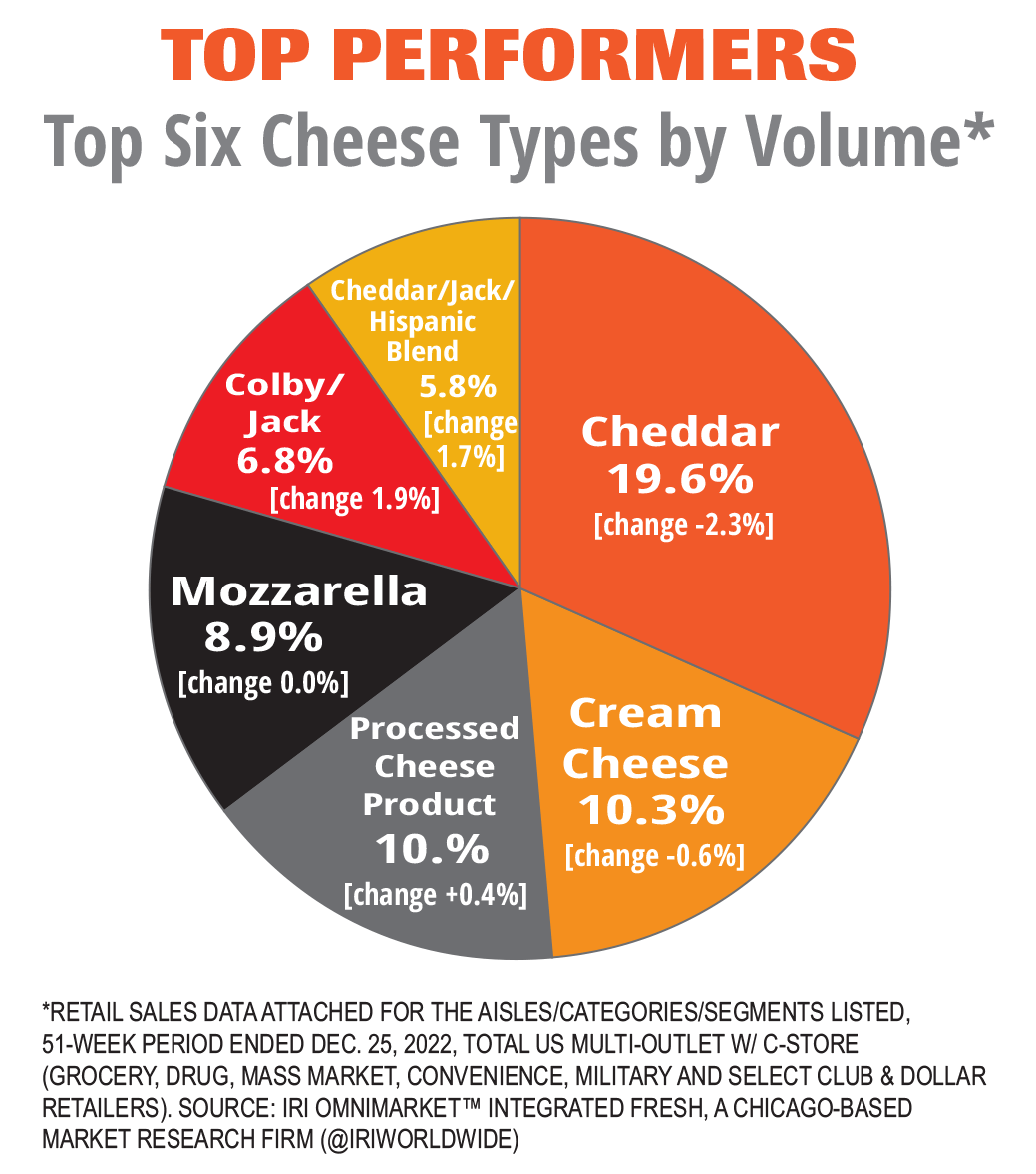

*Among the larger varieties, processed cheese product (10% volume share) and blended products such as Colby/Jack blended cheese (7% share) and Cheddar/Jack/Hispanic blended shreds (6% share) were growing in 2022 and during the end-of-year holidays.

TASTES, TYPES